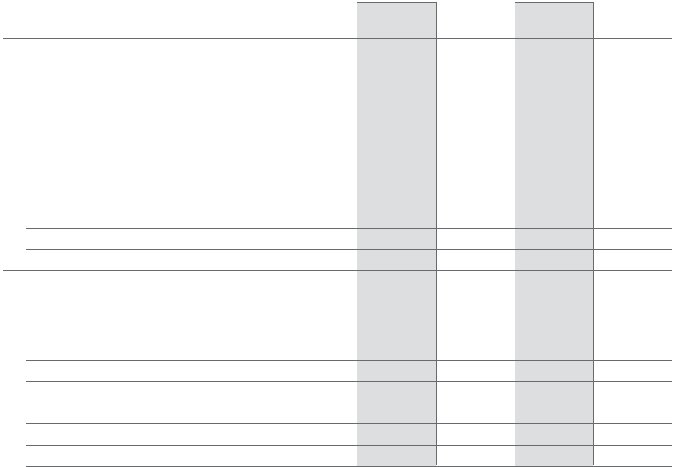

ArcelorMittal South Africa 2007 Annual Report Page 116

Group

Company

2007

Rm

2006

Rm

2007

Rm

2006

Rm

18. UNLISTED EQUITY ACCOUNTED INVESTMENTS

The investment represents interests in unlisted

incorporated joint controlled entities and an associate

At beginning of year

953

912

32

32

Net after tax share of results as per the income statement

270

135

Dividends received

(104)

(167)

Currency translation differences

(18)

83

Unrealised profit on sale

(8)

(10)

Acquisition of interest in associate

16

16

At end of year (Annexure 1)

1 109

953

48

32

Aggregate post-acquisition reserves

820

654

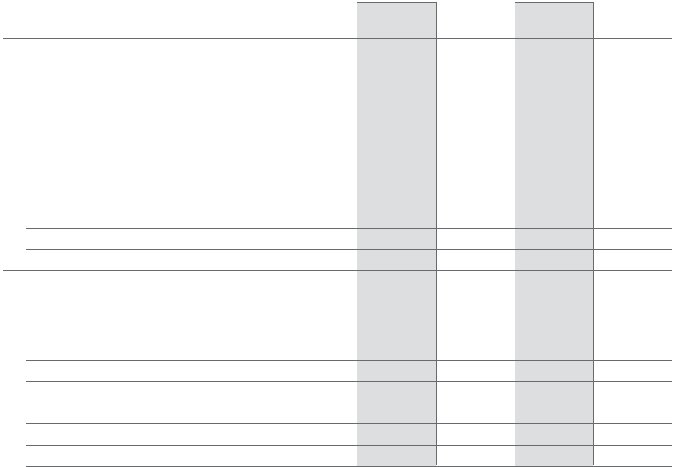

19. INVESTMENTS IN SUBSIDIARIES

Indebtedness

– by subsidiaries

5 553

6 266

– to subsidiaries

(94)

(126)

Total indebtedness

5 459

6 140

Net indebtedness after provision

5 459

3 341

Shares at cost (Annexure 1)

256

256

Total

5 715

3 597

Aggregate attributable after tax profits

1 241

914

The majority of the carrying value of the company’s investment in subsidiaries consists of its investment in Saldanha Steel

(Proprietary) Limited being the cost of shares and indebtedness, at the initial and subsequent acquisition dates.

In 2007 the remaining investment impairment of R2 799 million in the entity-own accounts of ArcelorMittal South Africa

Limited was reversed in full (note 9).

Notes to the group and company annual financial statements continued

for the year ended 31 December 2007