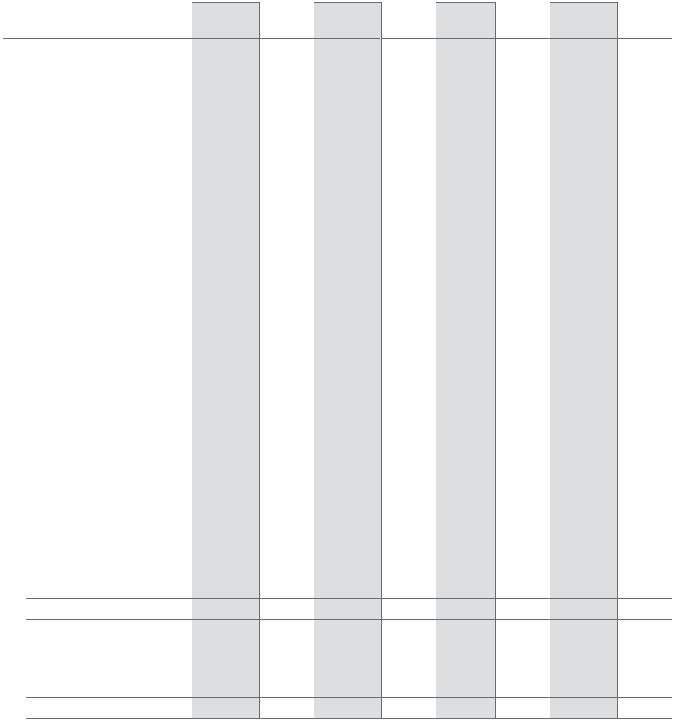

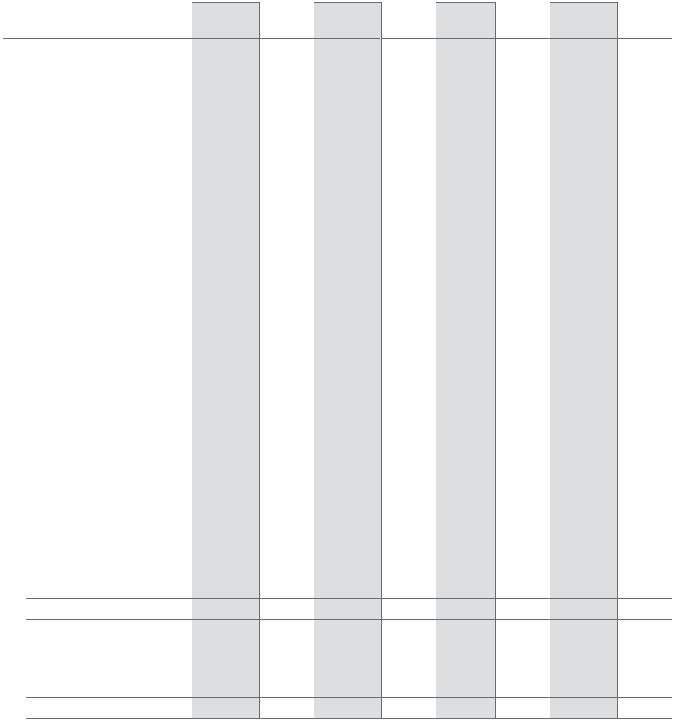

ArcelorMittal South Africa 2007 Annual Report Page 117

Group

Company

Non-current

Current

Non-current

Current

2007

Rm

2006

Rm

2007

Rm

2006

Rm

2007

Rm

2006

Rm

2007

Rm

2006

Rm

20. OTHER FINANCIAL ASSETS/

(LIABILITIES)

Derivatives designated as

hedging instruments carried

at fair value

Base metal forward purchase

contracts

• Un-matured

(53)

16

(53)

16

• Matured not settled

(14)

(14)

Financial assets/(liabilities)

carried at fair value through

profit or loss (FVTPL)

Embedded derivatives at FVTPL

124

134

94

117

124

134

94

117

Held for trading derivatives

that are not designated in

hedge accounting

relationships

• Base metal forward purchase

contracts

– Un-matured

2

1

• Foreign currency forward

purchase contracts

– Un-matured

0(1)

0(1)

(7)

0(1)

(6)

Available-for-sale (AFS)

investments carried at fair

value

Equity instruments(2)

71

Loans carried at amortised

cost

Loans receivable

103

Total

195

134

27

128

124

237

27

128

Included in the financial

statements as:

Other financial assets

195

134

94

135

124

237

94

134

Other financial liabilities

(67)

(7)

(67)

(6)

Total

195

134

27

128

124

237

27

128

(1)Rounding to zero due to the use of numeric reporting scale format of one million.

(2)The group holds 10% of the ordinary share capital of Hwange Colliery Company Limited, a coal, coke and by-products producer in

Zimbabwe. The fair value of the equity investment has been recognised in the current financial year, being an initial cost of R9 million and

subsequent fair value changes of R62 million. The latter has been transfered to an AFS investment reserve (note 25).