ArcelorMittal South Africa 2007 Annual Report Page 123

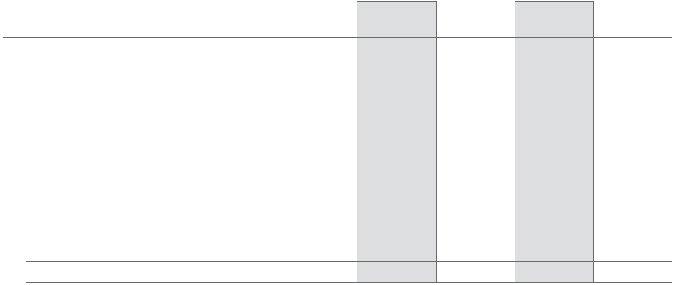

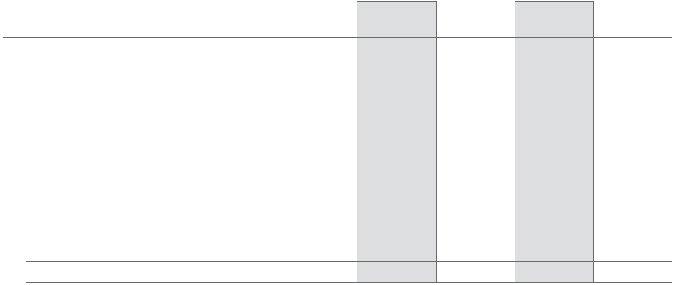

Group

Company

2007

Rm

2006

Rm

2007

Rm

2006

Rm

24. STATED CAPITAL

Authorised

1 200 000 000 ordinary shares at no par value

(December 2006: 1 200 000 000 ordinary shares at no

par value)

2 357 584 “C” redeemable preference shares at R10 each

(December 2006: 2 357 584 “C” redeemable preference

shares at R10 each)

24

24

24

24

Issued

445 752 132 ordinary shares at no par value

(December 2006: 445 752 132 ordinary shares at no par

value)

37

6 389

37

6 389

Total

37

6 389

37

6 389

During 2007, the company undertook to reduce its stated capital in terms of section 90 of the South African Companies

Act, 1973.

The capital reduction was undertaken in two tranches that were paid to qualifying shareholders on 3 September and

29 October 2007 for a cumulative amount of R6 352 million.

The capital risk management policy is described in note 32.17.

The group and company have a share-based payment plan in terms of which share options are granted to qualifying

employees. The plan is housed in the Management Share Trust, a special purpose entity, funded by ArcelorMittal South Africa

Limited.

As an equity-settled plan, the shares necessary to meet the Trust’s obligations under the plan are purchased in the open

market. Such share purchases are classified as Treasury Shares in terms of IAS 32 and are recognised in the Management

Share Trust reserve (note 25).

The unissued ordinary shares are under the control of the directors to allot and issue on such terms and conditions and at such

times as they deem fit until the forthcoming annual general meeting.