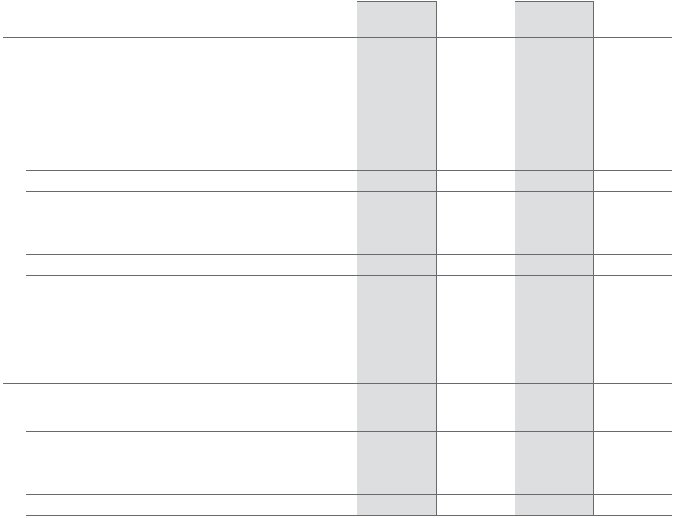

ArcelorMittal South Africa 2007 Annual Report Page 128

Group

Company

2007

Rm

2006

Rm

2007

Rm

2006

Rm

26. BORROWINGS AND OTHER PAYABLES

Borrowings

Unsecured – at amortised cost

Loan from Pretoria Portland Cement

61

71

Other payables

Cash-settled share based payments(1)

1

1

62

71

1

Included in the financial statements as:

Non-current borrowings and other payables

52

61

1

Current borrowings

10

10

Total

62

71

1

(1)Representing share appreciation rights. Refer note 36.1 ‘Share based

payments’ for the relevant terms and conditions.

The loan is unsecured and bears interest at a fixed rate of 16%

and is repayable annually with the final payment due in 2013.

There were no loan breaches or defaults during the current or

comparative period.

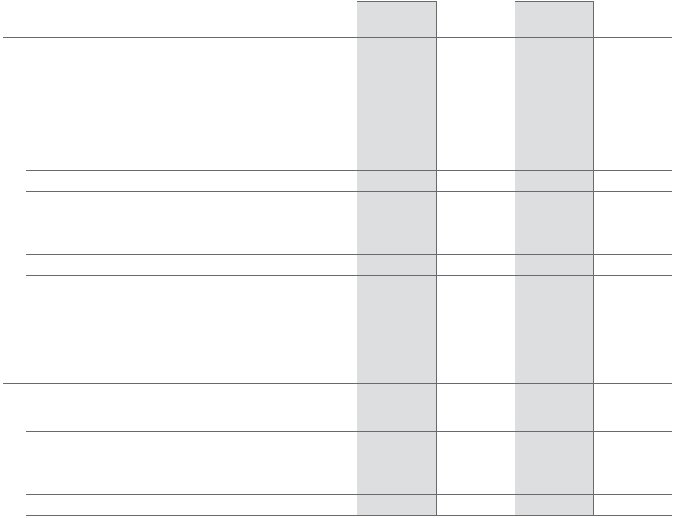

27. FINANCE LEASE OBLIGATIONS

Secured – at amortised cost

416

595

253

423

Included in the financial statements as:

Non-current finance lease obligation

328

502

174

337

Current finance lease obligation

88

93

79

86

Total

416

595

253

423

Secured by leased assets. The borrowings are fixed rate debt and the rates range from 7,86% to 22,25%. The final payments

in terms of the lease arrangements, sorted by functional type, are:

– Raw materials: 2010 – 2013

– Gases: 2016

– Electricity and transport utilities: 2018 – 2022

– Steel processing and foundry services: 2012

There were no loan breaches or defaults during the current or comparative period.

The following finance leases are embedded within supply arrangements with suppliers and have been assessed in terms of

IFRIC 4, Determining whether an arrangement contains a lease.

Notes to the group and company annual financial statements continued

for the year ended 31 December 2007